Sector Update / Metals / Click here for full PDF version

Author(s): Ryan Winipta ;ReggieParengkuan

- LME nickel price hits US$19k/t on intraday in Monday after US & UK imposed delivery sanctions on Russian nickel (i.e. Norilsk).

- Russian nickel made up c.36% of nickel inventory in LME-warehouse, but it remained uninterrupted for now, limiting the price impact.

- Indonesian nickel ore price, on the other hand, now trades at low-teens dollar premium above HPM (Fig. 8),is poised to benefit.

Sanctions on Russian metal sparked only a short-lived rally in LME

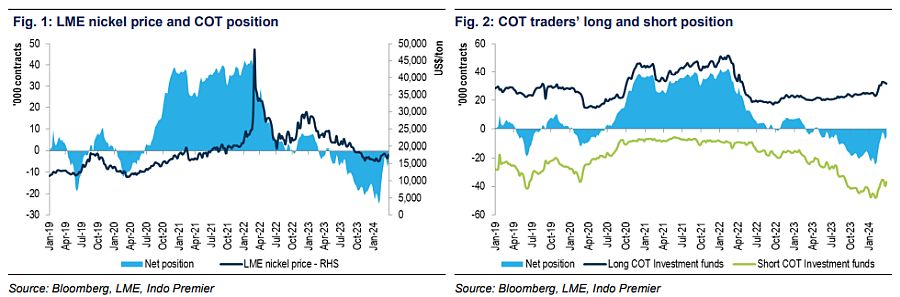

US and UK have imposed a fresh sanction on Russian metals (i.e. nickel, copper, and aluminium) by banning deliveries of the metals to LME. LME price rallied as much as c.8% post market open to US$19k/t but erased most of the gains at closing yesterday (c.+1%) as the upside to such sanctions would be limited given that: 1) old inventory of Russian metals currently sitting in LME warehouse (c.36% of total inventory) is uninterrupted - as only nickel after 13 April is prohibited for delivery to LME, 2) limited import-export activity between US/UK and Russia, while 3) COT traders' net-short position is down to 7kt (from 24kt at peak) and was not triggering any immediate short-covering activities (Fig. 1 & 2).

China economy improved but supply addition outpaced demand

China's positive economic data - i.e. 5.3% GDP growth vs. 4.8% consensus, and industrial production activity up by 6.1% yoy in 1Q - did not resulted in any increase in nickel-related products such as #300 stainless steel prices (Fig. 3) and NPI/FeNi prices (Fig. 4) as both prices were relatively flattish YTD. While demand was relatively robust particularly for household goods and manufacturing, the NPI supply addition from Indonesia and China (1Q24: +7%, Fig. 6), seems to outweigh demand improvement, limiting the upside in NPI prices. Note that Chinese RKEF cash-costs have also come down to US$12k/t, limiting the price re-rating upside from costs-support angle (Fig. 9). The only upside to NPI is potential NPI conversion to nickel-matte owing to the recent rise in LME prices.

Nickel ore price is set to be on the rise with higher premium and HPM

As LME nickel price went up quite significantly YTD (+8%, Fig. 7), nickel ore benchmark price (HPM) is set to increase starting Apr-24 and 2Q24F onwards, as the ore benchmark price lags actual LME price data by 1-2 months. In addition to higher HPM, our channel-check with traders have indicated that dollar premium to HPM currently stood at US$10-12/wmt starting early Apr-24 (Fig. 8) due to RKAB issues with only c.65% of quota approved. We thinkis poised to benefit from higher ore price + premium to HPM as they have started selling at premium since 4Q23.

Prefer LME nickel over NPI/Sulphate on potential sentiment tailwinds

We prefer LME nickel over NPI/FeNi and battery-grade nickel (sulphate) given the former's potential tailwinds as: 1) LME nickel price are more macro-driven and likely to follow the movement of other industrial metals (i.e. copper & aluminium), in comparison to NPI/FeNi & sulphate, and 2) potential demand improvement, coming from higher defence spending, as c.15% nickel-demand is used for plating/alloys, raw material for aviation and war equipment. We likeandas our key nickel top pick.

Sumber : IPS